TV Advertising Yearly Industry Report 2014

TV INDUSTRY REPORT gives the overall picture of advertising on TV during the period Jan’13 to Dec’14. It covers top advertisers, categories and brands and their % share in total advertising in terms of minutes along with comparison with 2013. The report also focuses on share of TV channels, share of each genre and ad-spend split over the time slots.

DATA SOURCE: MEDIA BANK PAKISTAN

BASE: Spot TVC’s

IMPORTANT: All the ranking are on the basis of minutes, which does not reflect the ranking on the basis of ad spend.

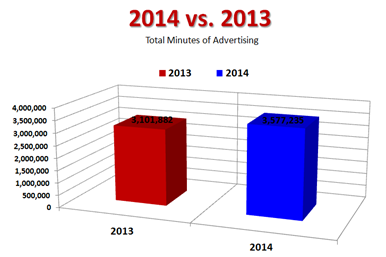

· The overall total minutes of advertising in 2014 jumped up by 15% compared to 2013.

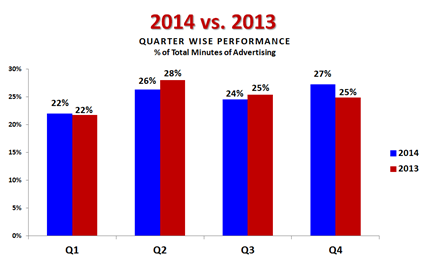

· Comparing the quarter-wise total minutes spend; the trend remains mostly similar across first three quarters. Last quarter of 2014 witnessed an increase of 2% over 2013.

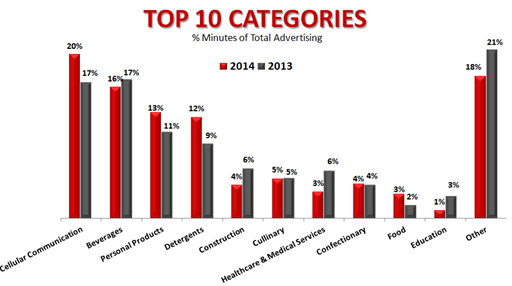

· The top five categories on TV remained the same across 2013 and 2014 including cellular communication, beverages, personal products, detergents and culinary. In the category of beverages, the advertising minutes spend 2014 dropped by 1% whereas it increased by 3% in detergents and cellular communication categories.

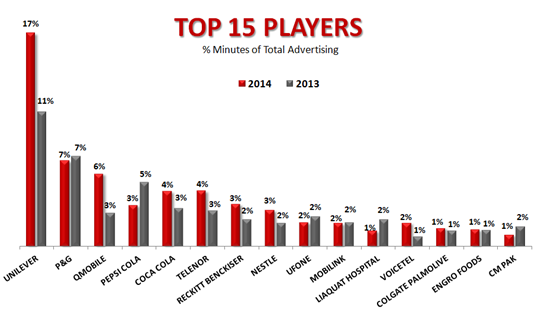

· The top players on TV for 2013 were Unilever (11%), P&G (7%), Pepsi Cola (5%), QMobile (3%), and Coca Cola (3%). The same players continue to dominate the TV advertising spend with an even increased percentage in 2014. However, there is a dip of 2% seen in advertising of Pepsi brands in 2014.

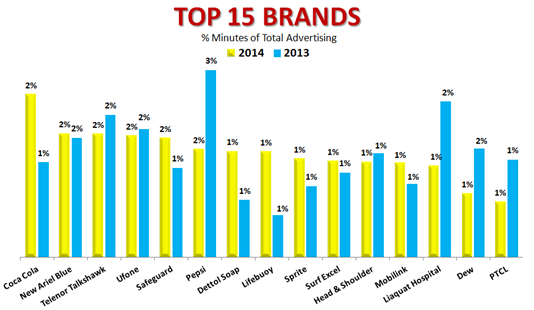

· Pepsi that topped the list in 2013 dropped its advertising spend in 2014 by 1%.

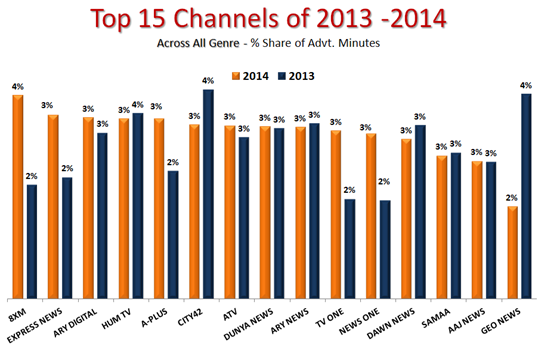

· The most significant drop of share of advertising across channels is witnessed by GEO by 2%. The he advertising spend increased mostly on channel 8XM in 2014.

· Similarly, for news channels, the share of advertising on GEO News dropped by 5% in 2014 and that of channel Abb Takk grew by 7% followed by Express News that grew by 3%.

· Among the entertainment channels, the major drop is seen across GEO (by 4%) and HUMTV (by 1%).

· In both years, channel 8XM retains the top position and increased its advertising spend share by 10% compared to 2013.

. The highest increase of advertising spend is seen on Jalwa with a 20% increase in its share in 2014.

· News and entertainment segments remain most popular with their share of 44% and 41% respectively throughout 2013 and 2014.

· The most popular time band for both 2013 and 2014 remains prime time slot (7pm to midnight) and afternoon (12pm to 5pm).

Complete Report:

Posted On June 16 2025

Posted On June 16 2025